Educating a Taxation Expert

Ranked third-best in the world in its category, our MSc in Taxation program enables students to acquire problem-solving and proposal skills in addition to the specialized knowledge needed to be an effective tax accountant, producing highly skilled professional accountants who can expertly advise clients on issues of management as well as finance.

The Certified Public Tax Accountant examination requires passing five out of a total of eleven subjects. Students who take the Accounting Finance course model and complete a master's thesis in the field of accounting can apply for an exemption from one subject in the accounting field. Furthermore, those who take and complete both the Accounting and Finance and Tax Law models in a minimum of three years are eligible to receive a double master's degree and exemption from up to three of the subjects on the Certified Public Tax Accountant exam.

MSc in Taxation Ranking

The Best Masters Ranking worldwide is a ranking of business schools conducted by SMBG, a France-based company, and is not biased towards any particular region. The ranking is based on evaluation of the program itself, salary after graduation, and satisfaction of the students.

-

World # 3 Tax Law

-

Asia # 1 Tax Law

-

Japan # 1 Tax Law

Environment

Systematic learning of business strategy on weekends

MSc courses instill comprehensive business management skills and knowledge required of business leaders to effectively guide their teams and make the key decisions that will shape their careers. Our curriculum is dedicated to helping students acquire the ability to look at management from the perspective of executives and managers in order to implement strategic thinking that provides sustainable benefit to the organization with every decision.

READ MORE

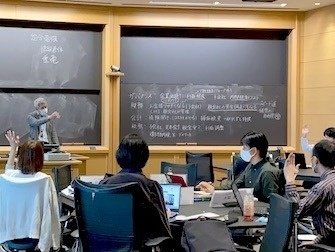

High quality practitioner faculty

More than 90% of our faculty members are practitioners who have been active on the front lines of business and have passed the strict international standards set by AACSB and AMBA on practical experience related to their teaching fields and publications. Unlike the unidirectional lectures designed for training researchers at other business schools, we provide practical learning directly related to business by conveying the experience and knowledge gained from business through participant-centered case method teaching.

READ MORE

Connect and study with ambitious tax professionals

Collaborate with a wide range of students from their mid-20s to 60s in case method-style lectures, group sessions, and class discussions, meeting and engaging with peers who have many years of experience in the fields of accounting and taxation, as well as various other industries and sectors. The program offers flexible options for students coming from varying circumstances. There are those who aim to pass the exam while working at a tax accountant's office, as well as those who aim to become corporate CFOs. 90% of students complete the program in the standard two years, but students have the option to extend their program duration to up to four years through the Long-Term Course System.

Current students by industry

Current students by age

Interview

Report

-

MSc in Taxation × Nihon University Football Case

- Report

The following is an introduction to the last day of the Business Law class taught by Professor Akitsuyu Ogawa, which was the first class of the 2022 spring semester at the NUCB Business School, MSc...

READ MORE

-

Business Analysis by Prof. Nobuyuki Kobayashi

- Report

In the tax accountant training course at our school, students do not only study taxation and accounting, but also learn about the overall management of companies that require these skills. In this ...

READ MORE

-

Financial Accounting by Professor Tetsuya Sano, Tax Accountant Training Course

- Report

This fall semester, NUCB Business School in Nagoya resumed face-to-face classes, which many of the students had been eagerly awaiting, and one course in each program was completed without a hitch. ...

READ MORE

-

A seminar camp was held to prepare the master's thesis for Professor Tetsuya Sano's seminar in the Certified Public Tax Accountant Training Course

- Report

In the Business School's Tax Accountant Training Program, thesis guidance seminars begin in the first year. Master's theses may be completed in seminars under the guidance of the professor in charg...

READ MORE

-

Live Virtual《Tax Accountant Training Course》 "Corporate Tax Law" by Visiting Professor Hiroshi Sasaki

- Report

Corporate Tax Law by Prof. Hiroshi Sasaki Corporate Tax Law Corporate Tax Law, a training course for Certified Public Tax Accountants by Prof. Hiroshi Sasaki, has started. Corporate tax is a tax le...

READ MORE

-

Live Virtual Class 《Tax Policy and the Economy》 Professor Yasushi Harada

- Report

Tax Policy and the Economy" by Professor Yasushi Harada, who joined our faculty in April 2020, is now offered virtually at our Tokyo campus studio. Course outline In this class, we will take a look...

READ MORE

About MSc in Taxation

What is a tax accountant?

In addition to passing the Certified Public Tax Accountant Examination, those who are exempted from taking the Certified Public Tax Accountant Examination for all subjects under the provisions of the Certified Public Tax Accountant Act, lawyers (including those who are qualified to be lawyers), and certified public accountants (including those who are qualified to be certified public accountants) are eligible to become certified public tax accountants. Those who have passed the exam and those who have been exempted from the exam are also required to have been engaged in accounting-related work (accounting work with balance sheet accounts and profit and loss statements) for a total of at least two years.

The Certified Public Tax Accountant exam requires you to pass five of the 11 subjects. Of these, two accounting subjects, bookkeeping theory, and financial statement theory are required. Three of the nine tax law subjects must be selected and taken. The tax law subjects include Income Tax Law, Corporate Tax Law, Inheritance Tax Law, Consumption Tax Law or Liquor Tax Law, National Tax Collection Law, Resident Tax or Enterprise Tax Law, and Fixed Property Tax Law. Of these, the Income Tax Law and the Corporation Tax Law are required elective subjects, so you need to pass three subjects, including one of either of them.

Since the Certified Public Tax Accountant exam is based on the "subject pass" system, candidates do not need to take all five subjects at once but can take them one at a time. This is one of the qualifications that are easy for working people to pursue while working.

-

Merit of MSc Program

Upon completion of this program, all students who applied for exemption of the Licensed Tax Accountant Examination at the National Tax Agency were granted exceptions.

-

Part-time MSc Curriculum

Complete the course in four days over two weekends. Master's thesis instruction seminars are held at night on weekdays once every two weeks, allowing you to balance your studies with your work schedule.

-

Double Master

Students who complete the Finance Accounting course can receive an exemption from one subject of accounting in the Tax Accountant Examination. Students who complete the tax law course can receive an exemption from two subjects within the tax law. A total of three examined subjects can be exempted by completing both courses.

Full Coverage of Taxation

MSc in Taxation program covers all of the required fields for licensed tax accountants. While enrolled in the program you will acquire specialist management knowledge through the MBA-based curriculum while increasing your strategic intellectual focus in taxation.

- Business Law

- Tax Law

- Income Tax Law

- Inheritance Tax Law

- International Taxation

- Consumption Tax Law

- Corporate Tax Law

- Business Analysis

- Financial Accounting

- Managerial Accounting

- Tax Accounting

- Tax Audit & Negotiation

- Corporate Valuation and Management

- Business Succession Planning & Mgmt.

- Mgmt. and Planning for Real Estate

- Mgmt. and Planning for Financial Products

International Network

Brochure & Application Guide

Download materials that comprehensively introduce programs of study, employment, and international exchange at the NUCB Business School, as well as materials that introduce in detail the schedule and examination subjects of last year's entrance examinations, a collection of entrance examination questions, entrance examination data, and entrance qualification examination forms.

Brochure

Brochure

Info Session

Info Session

Online Application

Online Application

MBA Basics

MBA Basics