Traditional economics and management are based on the assumption that decision-making by economic entities is carried out rationally. In practice, it is not uncommon for unreasonable decisions to be made, even in the face of large financial stakes, due to the human brain reacting to intuition and emotions more quickly than it processes rational thought.

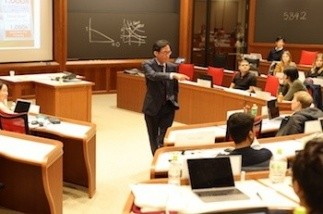

Behavioral economics studies the irrationality of human economic activities and seeks to improve decision making by recognizing these tendencies. This class is an introductory behavioral economics course with an emphasis on the application to business decision making. Basic insights into psychology are considered on topics including representativeness bias, availability bias, loss aversion, sunk cost and nudge. The course also covers financial decision making and finally motivation and engagement at the workplace.

Students are challenged to re-evaluate consumer behavior and psychology through “thought experiments” and in-depth class participation. By participating in this class, students can improve their managerial decision-making skills.

Professor Seiichiro Iwasawa, Ph.D, is a professor of Economics and Finance at the NUCB Business School, where he teaches Corporate Finance, Behavioral Finance, and the Case Writing at the Global Leader Program.

Before joining the faculty member at the NUCB, he worked for Nomura Securities (1987-2012), the largest investment bank in Japan, as a securities analyst and an equity market strategist. His main area of interests is behavioral economics and finance, and among his recently published papers are: "Hot Money and Cross-Section of Stock Returns during the Global Financial Crisis," International Review of and Economics and Finance 50(c), "The Beta Anomaly in the Japanese Equity Market and Investor Behavior," International Review of Finance 14(1), and "A Behavioral Economics Exploration into the Volatility Anomaly," Public Policy Review 9(3). He received MBA at Boston University, and PhD in Economics at Harvard University.

Brochure

Brochure

Info Session

Info Session

Application

Application

Alumni Voices

Alumni Voices