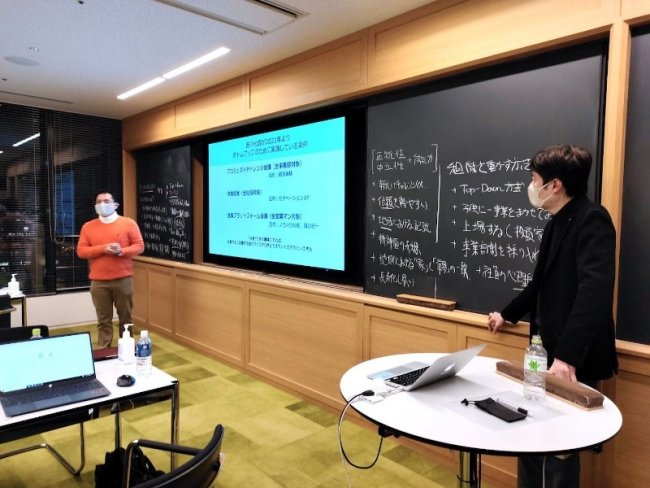

The 2nd Case Translation Network meeting was held at the Tokyo Marunouchi Campus in the midst of a thorough prevention of infection by the new coronavirus (COVID-19). The new coronavirus (COVID-19) has forced us to make major changes in our lives. New norms, such as changes in work styles and lifestyles that were previously unimaginable, are blending into our daily lives. In this session, we discussed the various changes and transformations that are occurring on the front lines of business, using two cases as our subjects. Both cases were presented by Shiho Okamura and Mari Kashiwamura, both of whom are enrolled in our tax accountant training program, and were based on their own companies. The second case, "SWOT Analysis of Elm Corporation - Strengths and Weaknesses," was about Elm Corporation, the largest certified tax accountant corporation in the area, founded in 1971. Ms. Kashiwamura is also a director of the company, so she also spoke about management as seen from a woman's perspective. Each discussion session in the network provides a valuable time for the various participants to actively exchange opinions and discover great insights and sharing.

Brochure

Brochure

Information Session

Information Session

Online Application

Online Application

MBA Basics

MBA Basics